Digital Money Academy

With the continuous momentum that digital forms of money are gaining around the world, educational efforts about its key concepts are not keeping pace, resulting in staggered discussions about different aspects of CBDCs, stablecoins and other forms of digital money, leading to rising levels of uncertainty. The Digital Money Academy moves the needle in this matter in a positive direction.

Digital Money Academy on Central Bank Digital Currencies (CBDC)

The Digital Money Academy on CBDCs aims at educating the general public and covers key concepts such as an introduction to CBDCs, technology, lessons learned from central banks worldwide, the current status quo of CBDC development worldwide, use cases and value propositions of retail CBDCs.

These aspects are presented by industry experts involved in the design, research and discussions on the implications of retail CBDCs. The format allows for lectures of sufficient depth to gain a general understanding of CBDCs and their impact on the future of digital money.

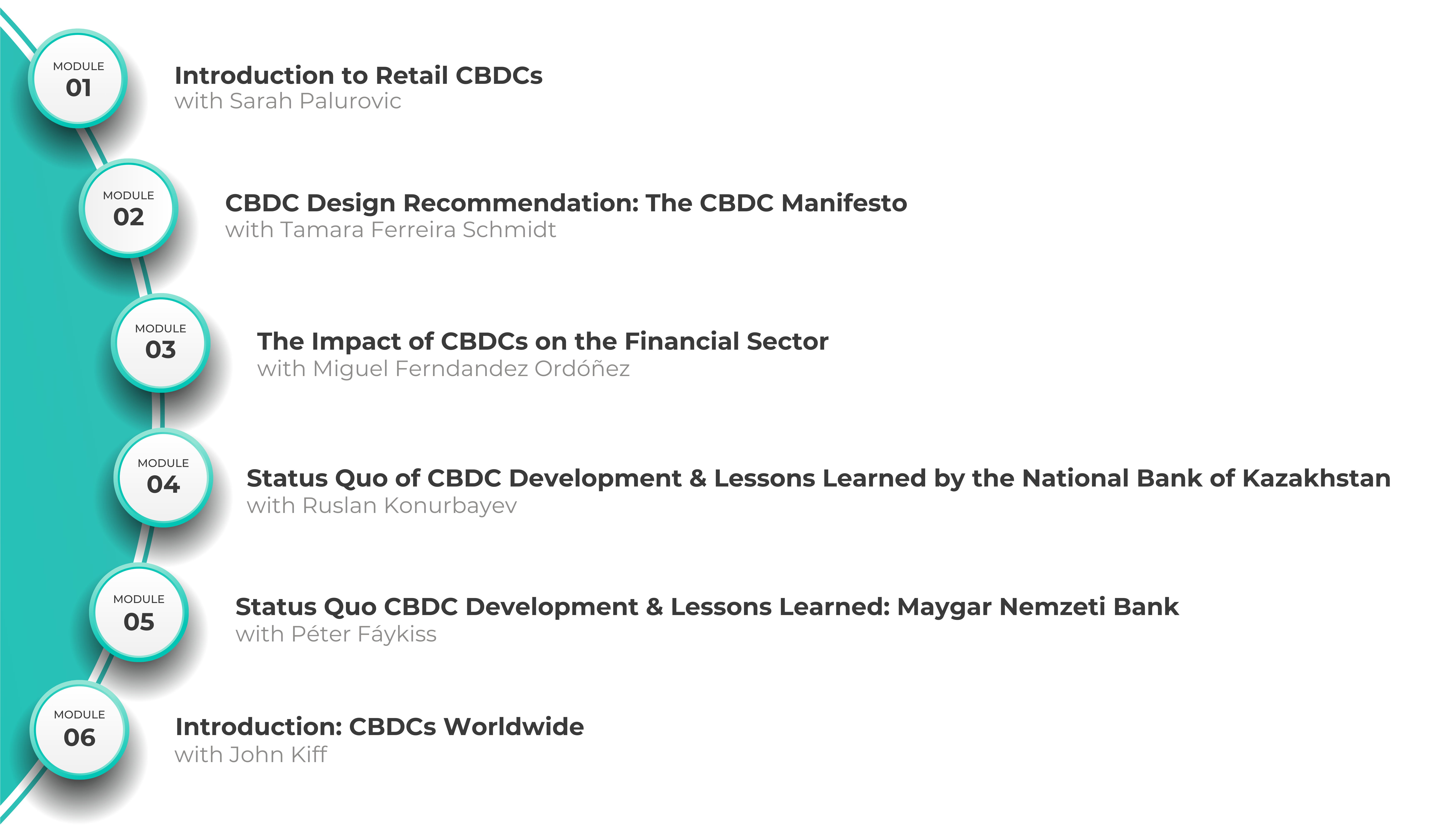

Course Outline

“I have greatly benefited from my time and experience with the Digital Euro Association. Participating in their activities has enriched my knowledge and expertise in blockchain and CBDCs, significantly contributing to my professional development. Furthermore, the unique network I have built within the association has facilitated engaging exchanges and the sharing of valuable insights with like-minded individuals.”

Hamza Ali Mohammed

EMTECH

Lecturers

Tamara Ferreira Schmidt

Module: The CBDC Manifesto

Tamara Ferreira Schmidt is Executive Director of the Digital Euro Association. She specializes in Financial Engineering, Capital Markets and Derivatives with over 15 years of experience. Consultant and creator of personalized content about investments, startups, innovation, digital currencies and blockchain, Tamara has already lectured at Brazil-Germany Fintech eTour, TEDx KanzlerPark, Web 3.0 Disruptors Week, Crypto Assets Conference, Digital Euro Conference, Brussels Blockchain Week, CBDC Conference among other events.

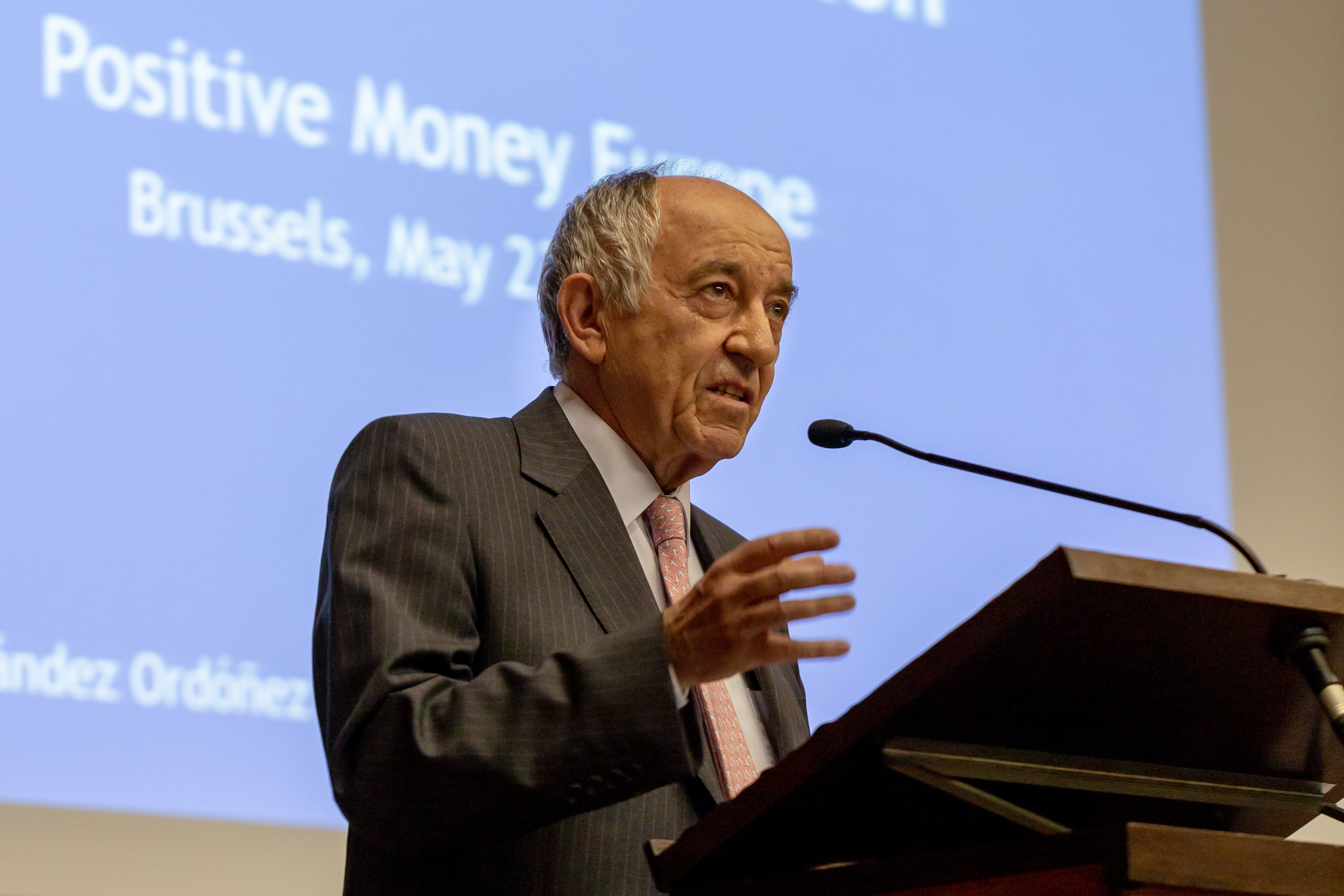

Miguel A Fernandez Ordoñez

Module: The Impact of CBDCs on the Financial Sector

Ex-Governor of the Banco de España and member of the ECB Governing Council between 2006 and 2012. He was previously Secretary of State for the Economy, Secretary of State for Commerce, Secretary of State for Finance and Budgets, and President of the Competition Court. His latest book, "Adios a los Bancos", is dedicated to CBDCs and the liberalization of banking activities.

Peter Faykiss

Module: Status Quo of CBDC Development & Lessons Learned by the Maygar Nemzeti Bank

Peter Faykiss is the Director of Digitalization Directorate at the Magyar Nemzeti Bank (Central Bank of Hungary), where he is responsible for FinTech, digital finance and digital currencies topics. Before entering the digital finance area, he gained experience in financial stability and macroprudential policy. As the Head of Division for Banking Regulations of Ministry for National Economy he was responsible for the domestic implementation of the European regulatory package CRD IV in 2013. In 2014 he was appointed as the Head of Macroprudential Policy Department of the MNB, from 2017 he served as the Director of Macroprudential Directorate.

John Kiff

Module: Introduction to CBDCs Worldwide

John Kiff was a Senior Financial Sector Expert at the IMF from 2005 to 2021 where he focused on financial stability and fintech issues, and OTC derivative market infrastructure. Before that, he was at the Bank of Canada for 25 years where he spent most of his time managing the funding and investment of the government’s foreign exchange reserves. More recently he has been focusing his independent consulting work on digital currencies and financial market infrastructures.

.png?width=1619&height=1080&name=Black%20and%20White%20Modern%20Minimal%20Creative%20Design%20Portfolio%20Presentation%20(2).png)

After this one day Digital Money Academy, you will be able to

- Understand and explain different kinds of CBDCs, their functions and their specific use cases

- Identify and judge the suitability of intricate CBDC design features for different monetary policy goals and CBDC developments worldwide

- Understand the progress of CBDC development and lessons learned in Hungary and Kazakhstan

- Discuss key technological aspects of CBDCs and grow your understanding for CBDCs in practice

- Identify and evaluate potentials, risks of CBDC implementation and cybersecurity risks

- Identify and evaluate value propositions of CBDCs

- Assess the impact of CBDCs on the financial sector and financial stability of a country or a currency union

- Identify sources and strategies that support the students to stay up to date with the newest CBDC developments

- Employees, executives and decision-makers from the financial sector interested in the future of digital money and advancements of the monetary system

- Decision-makers and employees from the financial and capital market industry who are affected by the introduction of a CBDC

- Consultants with a focus on capital markets and digitization

- Scholars that are doing research on digital currencies, financial stability, welfare and monetary policy

- Journalists from the economics and technology department

- Employees of startups with digital business models

- Other groups of people with an interest in CBDCs, technology, and digitization

- Get up to speed with cutting-edge retail CBDC knowledge from a technological, economic, political, and social standpoint within a day

- Be guided through a comprehensive learning path

- Learn from experienced industry experts that are involved in the design, research and implications of retail CBDCs on a daily basis - in theory and in practice

- Take advantage of the interactive nature of the course

- Benefit from networking opportunities with the lecturers and participants from relevant backgrounds

- Garner knowledge from leveraging the broad network of experts and community within the DEA network during the academy and beyond

Join us and influence the future of money